Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

The credit rating agency Fitch recently lowered the credit rating of U.S. debt from “AAA” to “AA+” due to fiscal and political instability. Despite this, U.S. debt inflation has not occurred this year. Many central banks worldwide have borrowed heavily in recent years to loosen their debts, and even the central banks of China and Japan are currently issuing bonds to expand their balance sheets. It is still being determined why only the U.S. debt has been downgraded.

Some argue that the U.S. debt rating was lowered due to the two parties in the U.S. getting too close to the debt ceiling crisis, which almost caused the U.S. to default technically. However, this argument is not valid based on experience. The U.S. debt ceiling has been raised nearly 70 times, often multiple times within a single presidential term.

During the 1980s, the Star Wars project was launched by Ronald Reagan, and he significantly increased national defense and fiscal expenditures. He also raised the debt ceiling almost ten times during his eight-year tenure, from $1 trillion to $2.8 trillion. However, it is unlikely that this will be seen as a downgrade.

Could the high possibility of debt default risk be due to the U.S. having too much debt and borrowing if it is not a political issue? According to data, it took the U.S. government 221 years to accumulate $21 trillion in debt from zero in 1776 to 1997. In contrast, in the past four years alone, the debt has surged by $21 trillion, a much faster growth rate than the economy. Many believe this is the primary reason for the downgrade.

Upon careful consideration, it becomes evident that the U.S. debt has increased significantly; however, the rate of increase is slower than in other countries. Additionally, compared to other developed economies, the debt-to-GDP ratio of the U.S. is low at 133%. Japan has a ratio of 256%, Greece 206%, Italy 154%, and Singapore 137%. Therefore, it is reasonable to suggest that world powers have more debt leverage and that the U.S. debt is not large enough to destabilize its finances completely.

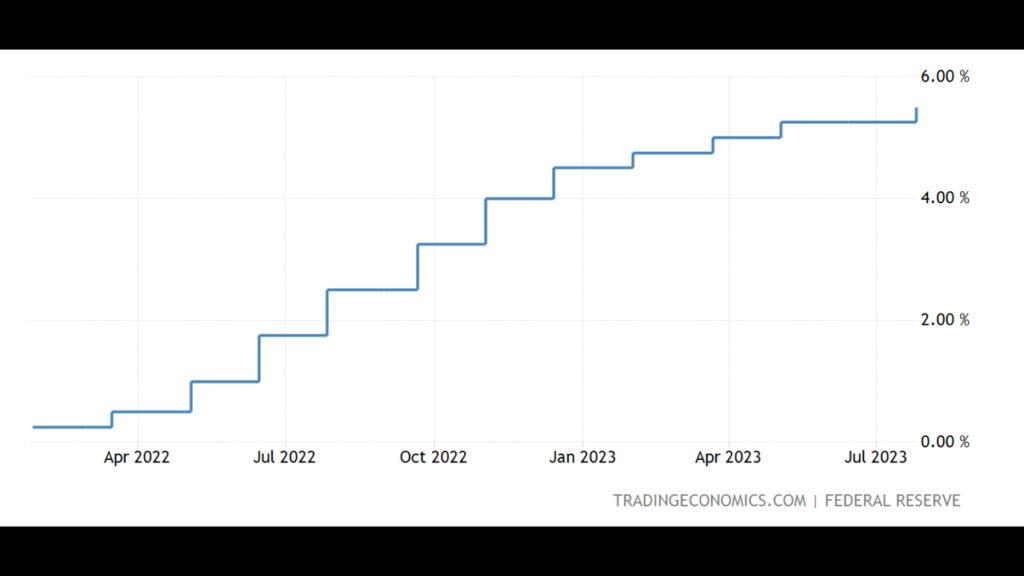

The primary reason is the Federal Reserve’s recent interest rate hikes, which have increased by 525 basis points in 17 months. As a result, the U.S. interest payments have reached 900 billion dollars this year, surpassing the 800 billion dollars spent on defense. Furthermore, 18% of the government’s expenditures are allocated towards paying interest. Currently, the cost of debt is rising by a trillion dollars annually. Unless interest rates are lowered, fiscal policy’s focus will likely shift toward debt repayment.

The rise in interest rates has caused the Treasury to increase the cost of issuing bonds, which may have weakened the U.S. government’s ability to repay its debt and led to a downgrade. It may be reasonable to assume that emerging markets and corporate bonds worldwide would also be downgraded, given that most central banks are raising interest rates. However, only U.S. Treasury bonds are downgraded, and the impact on corporate bonds appears minimal.

While interest rates affect corporate bonds, their decline in the last two years has been due to a drop in price after the yield rate has risen rather than due to widespread default. According to experience, net debt payments will increase during a rate-hiking cycle as the Fed tightens monetary policy, which may lead to lower profit margins and slower economic growth in two to three quarters. However, corporate net interest payments have decreased this time despite the vigorous rate hikes.

What could be the reason behind this outcome? The economy is on the verge of recovery, and the worst financial conditions for businesses have already passed. The financial reports of the top five U.S. technology companies in the second quarter indicate that the lowest revenue point was reached in the last quarter of the previous year, and the financial situation has been gradually improving since then.

In addition, it has been revealed that companies took advantage of the near-zero interest rates, particularly before and during the pandemic, by refinancing a significant amount of their debt into long-term, low-interest fixed debts. As a result, market borrowers were not significantly affected by the sudden increase in interest rates. In the mortgage market, less than 10% of buyers in the U.S. opt for a 30-year mortgage with a 7% interest rate.

As a result, the credit rating of the U.S. debt has been lowered. This could lead to a significant increase in interest rates, thus placing more financial burden on the Treasury. However, it remains the fact that U.S. debt is still considered a safe investment option. Apart from U.S. government bonds, is there any other bond that offers such high levels of capital protection?