Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

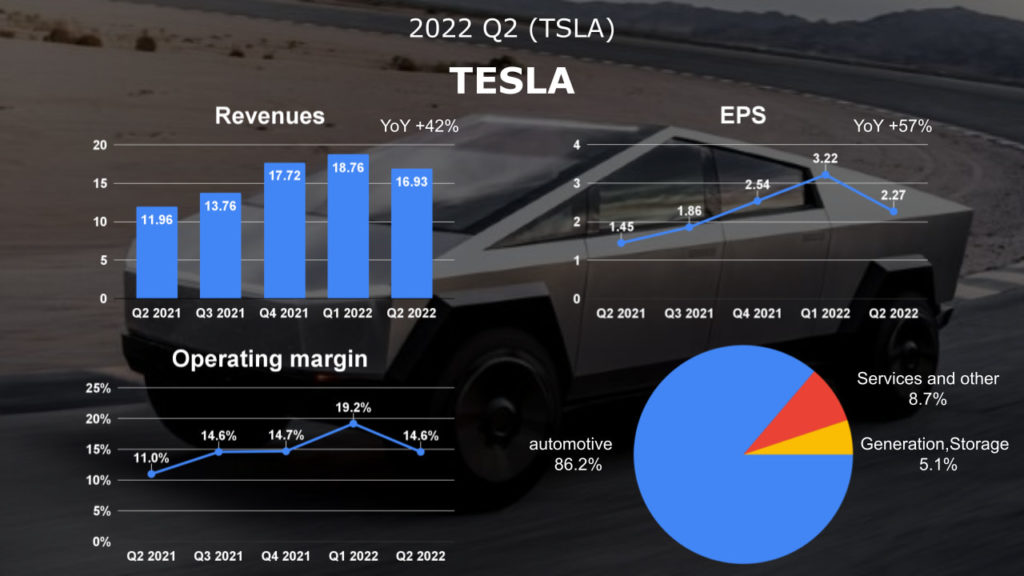

In Tesla(TSLA) 2022 Q2 financial results, the annual growth rate of revenue was 42%, reaching 16.93 billion, which was lower than the market expectation of 17.1 billion. The gross profit margin dropped 27.9% from 32.9% in the previous quarter due to Shanghai’s supply chain lockdown and inflation. EPS of $2.27 beat analysts’ expectations of $1.81. Tesla’s goal of an average 50% increase in deliveries over the next few years remains unchanged.

Revenue and EPS decline compared to 2022 Q1, but still better than market expectations.

Automotive gross margin declined to 27.9%, the lowest in nearly a year.

Tesla will continue investing in production capacity expansion to maximize capacity as much as possible and is looking forward to setting a record in the next half of the year.

By Q2, Tesla had converted about 75% of its Bitcoin to fiat currency, adding about $936 million in cash to its Q2 balance sheet. Digital currency assets have fallen to $218 million from $1.26 billion in Q1, with a $142 million loss in bitcoin that has hurt Q2 earnings.

2022 Q2 Tesla’s revenue reached US$16.934 billion, an increase of 41.26% compared to the same period last year, which is a reasonable growth rate, considering Tesla’s shutdown in Shanghai in Q2.

Operating income reached 2.464 billion US dollars, with an annual growth rate of 87.8% and an operating margin of 14.55%. Also, due to the Shanghai shutdown, it declined significantly from Q1’s 19.21%, but it can still maintain the level in the second half of last year. In terms of net income, 2022 Q2 Tesla net income reached $2.269 billion, with an annual growth rate of 92.61%, and Diluted EPS earned $1.95.

Automotive revenues amounted to $14.6 billion, of which regulatory credits contributed $344 million. Automotive gross profit reached $4.081 billion, Automotive gross margin was 27.9%, and the gross profit margin after deducting regulatory credits’ contribution was 26.2%. The main factor affecting the gross margin, which has declined compared with the previous quarters, is of course the idleness of the Shanghai factory during the lockdown and the initial production of the two new factories, which has lowered the gross profit margin.

The Energy business also made meaningful progress in Q2.

Energy generation and storage revenues reached a record high of US$866 million. More importantly, after two consecutive quarters of negative gross profit, Tesla’s energy business has finally returned to positive gross profit this quarter with 11.2% and set a record for the highest gross profit.

In Q2, Services and Other businesses returned to a positive gross margin. The used car business remains strong, particularly as interest in electric vehicles expands.

The revenues of Services and other in 2022 Q2 reached US$1.466 billion, with an annual growth rate of 54.15% and a gross profit margin of 3.8%. The main growth driver comes from the sales of used cars, as well as the growth of peripheral and maintenance services.

In 2022 Q2, Tesla produced 16,411 Model S/X units and 242,169 Model 3/Y units. The production capacity of Model 3/Y, mainly produced in Shanghai, has been greatly affected compared to Q1’s 290,000 units.

Tesla delivered 16,162 Model S/X and 238,533 Model 3/Y, bringing the total number of deliveries to 254,695. Although it was down from the previous two quarters, compared to the same period last year, there were still growing up 26.5% of the vehicles delivered. The demand for Tesla in the market is still much higher than the supply, and the overall supply and demand situation is still very short of supply.

Tesla Fremont Factory made a record number of vehicles in Q2. At present, the annual output can reach 650,000 vehicles.

The new factory in Texas has added production capacity that can switch between traditional batteries and structured batteries. The related equipment for 4680 batteries has also been installed, and it is estimated that the production capacity can continue to increase.

After the shutdown in April and May, the Shanghai factory resumed regular operation in June and also set a historical monthly production capacity record.

Currently, Berlin Factory has reached 1,000 Model Y units per week.

Tesla expected that production capacity will continue to rise in the second half of this year.

Solar deployments increased by 25% YoY in Q2 to 106 MW, the strongest quarterly result in over four years.

Energy storage deployments decreased by 11% YoY in Q2 to 1133 MWh, mainly due to shortages in the semiconductor supply chain. However, the market demand for energy storage products is still higher than Tesla’s supply capacity, and Tesla is accelerating the increase in the production capacity of their dedicated Megapack factory.

1. Tesla’s full-year production this year should have a very high chance of reaching the original expected 50% growth target. It is estimated that this year’s 2022 production should be around 1.4 million units. It seems that the Texas plant has obtained enough supply of 2170 batteries, which can smoothly increase production in the second half of the year and solve the backward progress of 4680 batteries.

2. According to Musk’s financial report, we can estimate that by the end of the year, Tesla will have an annual production capacity of 2 million cars, and the two new factories in Berlin and Austin can reach annual production. The production capacity of 200,000 vehicles. It is reasonable to estimate that Tesla’s production capacity in 2023 can reach the production of 2.2-2.4 million vehicles, which is another 50% increase compared to 2022.

3. Tesla undoubtedly has an outstanding ability to resist inflation and economic recession. For inflation, Tesla can increase product prices to offset costs. For economic recession, Tesla has long queues. The meaning of the order is that even if there is a partial decline in demand, it may still be higher than Tesla’s supply capacity.

4. Even though Tesla’s FSD is currently just an L2 self-driving system, the real value and capability of this system far exceed that of many “L3” systems on the market. We could look forward to the full rollout of FSD in the second half of this year and the future revenue contribution this system can generate for Tesla.

5. For the energy business, Tesla should have gone through the most challenging period, and the future should continue going upward.

With high oil prices, the demand for solar systems should increase significantly, which will provide important support for Tesla’s energy business, and now gross profit margins are starting to increase significantly.