Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

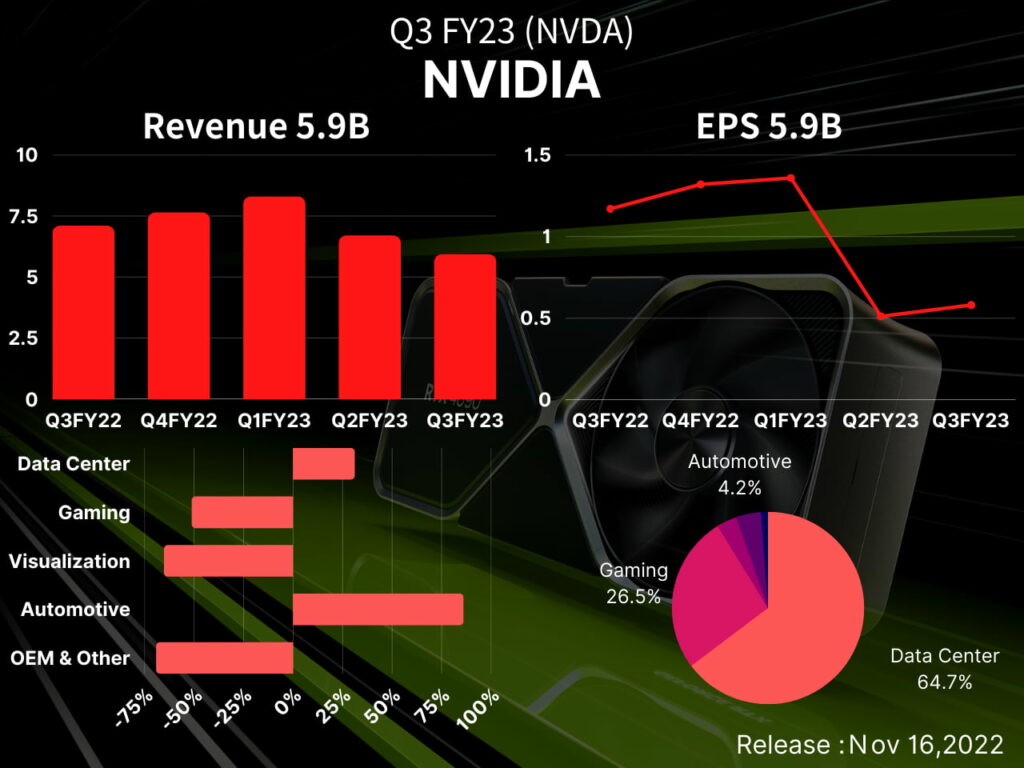

NVIDIA (Nasdaq: NVDA) Q3 FY2023 revenue decreased by 17% to 5.93 billion US dollars, better than the expected 5.77 billion, and EPS halved to 0.58 US dollars, lower than expected. The gross profit margin rebounded to 56.1% under the lower inventory cost. Although the Q4 revenue is slightly lower than the market consensus, the gross profit margin expects to recover further.

NVIDIA’s revenue is excellent, but profits have halved. Fortunately, the Data Center business is still better than expected.

| NVDA | Q3 FY23 |

| Financial Results | Financial information |

| Quarterly Presentation | Investor Presentation |

Nvidia announced its Q3 financial report. Revenue decreased by 17% to 5.93 billion, which was better than the expected 5.77 billion, but EPS of 0.58 was lower than the expected $0.7. Data center revenue still increased by 31% year-on-year due to the demand from US cloud service companies.

The Gaming business is also due to weak mining demand and PC demand, and the excessive inventory of old products has to reduce to clear the merchandise, and the revenue has decreased by 51% year-on-year. Gross profit margin also reduced by 11 percentage points year-on-year to 56%.

The revenue declined by 51% year-on-year in the “Gaming” business, but the “Data Center” and “Automotive” divisions hit record highs again.

“Data Center” revenue increased by 31% year-on-year to US$3.83 billion, surpassing analysts’ expectations of US$3.72 billion, once again widening the gap with the “Gaming” business and firmly sitting in the most significant sector.

Predicts that Q4 fiscal 2023 revenue will be US$6 billion, with an annual decrease of 21%. Revenue has declined for two consecutive quarters, and the decline has further expanded. At the same time, it has yet to reach the market expectation of 6.09 billion. 66%, NVIDIA expects that by the end of Q4, the inventory level should be close to the average level.

CEO Jensen Huang said that the company is quickly adjusting its pace to adapt to the general environment, paving the way for new products while clearing inventory. He emphasized that various new products launched at an accelerated rate, including GPU, AI, autonomous driving, and Metaverse. It will be the basis for the next stage of growth.

NVIDIA currently has approximately $8.28 billion of stock repurchase authorization remaining.

Gross margin fell by 10.9 percentage points to 56.1%, mainly due to the recognition of an expense of US$702 million related to destocking, most of which reflected the decline in demand for “Data Center” in China, of which about 50% were on hand Inventory. The other half is the purchase contract signed when the chip was in short supply. However, because the expenses recognized in this quarter were lower than in Q2, the gross profit margin rose by 10.2 percentage points compared with Q2.

Free cash flow has declined significantly compared to Q2 and last year, which is related to the decline in the company’s operations; inventory turnover days are much higher than in the same period the previous year and Q2, which is associated with the stocking of new products in Q4.

Gaming fell by 51% year-on-year and 23% quarter-on-quarter. The overall economic headwinds and China’s blockade measures continue to hit consumer demand. The company and retailers are working together to adjust inventory, and shipments have also decreased.

The simultaneous decline in GPU sales of desktops and notebooks is the main reason for the year-on-year decline in revenue. However, looking at the quarter-to-quarter changes, the demand for desktops has picked up. The quarterly decrease in revenue is mainly due to the sluggish demand for notebook GPUs dragged down.

NVIDIA pointed out that due to the conversion of the Ethereum verification mechanism, the supply of GPUs in the second-hand market has increased, which may impact the sales of some products.

Data Center business increased by 31% and 1% quarterly. The demand for cloud service providers in the United States mainly drove revenue growth. The CEO added that he saw the surge in need in the AI field and the change in China. Demand slows down.

In response to the new export ban imposed by the US government, NVIDIA revealed that Q3 revenue was indeed affected, but the rise in demand for substitutes mainly offset the decline in sales of high-end chips. But the CFO also warned that China issues would weigh on the business for some time.

Professional Visualization segment dropped 65% from last year and 60% quarter-on-quarter.

This business mainly sells high-end GPUs and related solutions to professionals. Sales in this area in Q3 declined due to inventory problems.

Automotive grew by 86% year-on-year and 14% quarter-on-quarter, mainly driven by autonomous driving and AI cockpits. Although its development is accelerating, revenue accounts for less than 5%.

OEM and others dropped by 69% and quarterly by 48%. In addition to the slowdown in OEM notebook sales, the company once again stated that the current contribution of CMP to revenue is only “nominal” (it disclosed no specific figures). NVIDIA launched this mining card to prevent mining demand from crowding out real gamers. CMP revenue was US$105 million in the same period last year.

However, although the performance has dramatically improved, the price has also increased simultaneously. It is considering the current sluggish demand for PCs, the slowdown in mining demand, and the pressure on channels to clear inventory. The new products may only be able to stimulate revenue for a short time significantly.

According to “TechSpot” statistics, the quotation of NVIDIA RTX 30 series stopped falling and rebounded in October, and the average price rose slightly by +4%

. TechSpot pointed out that the inventory seems to have begun to decline after the distributors’ vigorous promotions, leading to a rebound in the price of high-end GPUs. However, under the pressure of the latest GPUs, they are still substantially lower than the suggested retail price for lower-end products. , Since NVIDIA will launch the corresponding new models next year, the price is relatively supported and has even generally risen above the suggested retail price.

As for the tense relationship between the United States and China, NVIDIA previously estimated that revenue would be affected by 400 million US dollars. But recently announced that it has found a solution and will “tailor-made” a high-end chip (A800 GPU) that meets the requirements of China. ), which can circumvent the US Department of Commerce’s export restrictions as an alternative to A100 chips.

In addition, before the financial report, NVIDIA announced that it would expand the Data Center market share and is cooperating with Microsoft (MSFT) to build a super-large computer. It plans to use many NVIDIA GPU chips, high-end chips, and networks in this new AI product. Products and Software.