Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

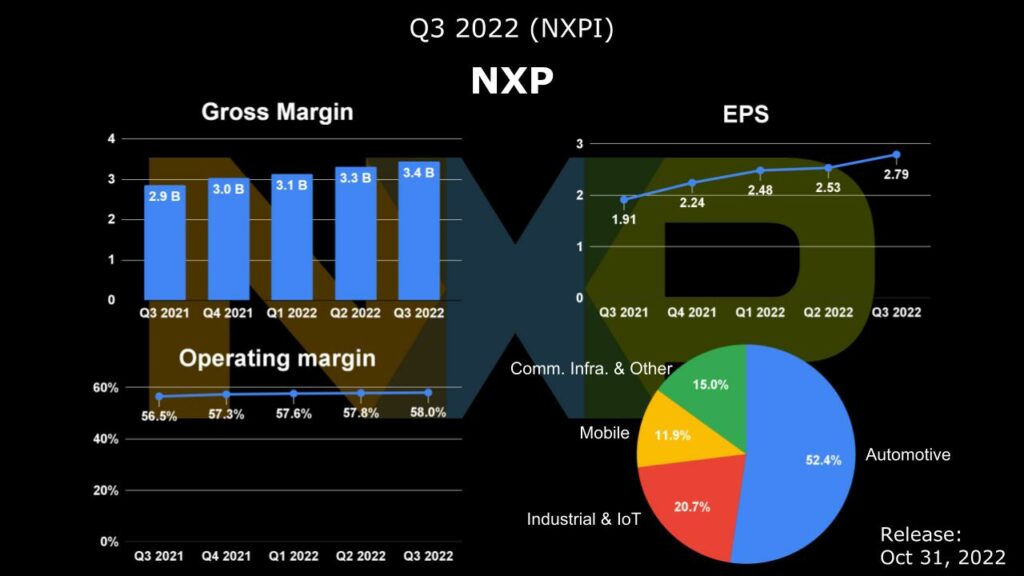

NXP Semiconductors (NASDAQ: NXPI), the world’s second-largest automotive semiconductor manufacturer, announced its Q3 earnings report and financial results. Revenue increased by 20% to 3.44 billion, the gross profit margin was 58%, the operating profit margin was 36.9%, and the net profit increased by 42%. EPS of $2.79 was better than expected.

Due to the slowdown of the overall economy and the downturn in the consumer-side IoT business, the demand in the automotive and industrial markets is still resilient. Although the growth rate of the automotive sector, with the highest proportion, has slowed to 24%, it is mainly due to the gradual improvement of the supply chain. The slowing sectors include industry and IoT, and communication infrastructure is growing faster.

The overall environment is highly uncertain, and the company is cautious about the medium term.

Looking forward to the future, considering that it is still plagued by supply chain constraints and the general economic environment is full of uncertainties, the company is cautious about the medium-term trend.

| NXPI | Q3 2022 |

| Financial Results | Financial information |

| Quarterly Presentation | NXP Investor Presentation |

Third Quarter 2022 Results revenue, the four significant businesses contributed to the “double-digit” annual growth, and the “automotive electronics” grew the fastest. The income of this department increased by 24% to 1.804 billion. It can be noted that, just like the company mentioned above, The “Industrial and IoT” business encountered some obstacles (QoQ was flat), but the “Mobile Communication” business started to recover.

Gross profit margin (58%) and operating profit rate (36.9%) were significantly higher than last year (56.5%, 33.5%), both of which also reached the high financial forecast given in Q2 and rewrote the past three years’ new highs.

The Days Inventory Outstanding (DIO) increased from 94 days in the previous quarter to 99 days, which is the third consecutive increase, which means that the company’s inventory consumption has slowed. Although considering the strong end demand, this number is about the same as the 5-year average, which may mean the inventory has not increased excessively. It is only a sign of the supply chain shortage, but it has exceeded the company’s average expectation for 2021-2024 and is worthy of continuous attention!

Is car demand so strong? As more than 60% of vehicles on the road have not yet installed Advanced Driver Assistance Systems (ADAS), it is expected that the future demand for environmental detection, power control, Internet of Vehicles, cockpit audio and video, and A.I. chips will significantly promote the growth of automotive semiconductors.

According to “McKinsey” estimates, the automotive chip market will grow from about US$50 billion in 2021 to about 150 billion in 2030, with a Compound Annual Growth Rate (CAGR) as high as 13%. The automotive field will be the largest in the semiconductor industry—the application category with the most robust growth momentum.

The two areas with the most robust growth are “automotive and industry,” which are the primary revenue drivers of NXPI, accounting for 73% of NXPI’s revenue.

In addition, to move towards the goal of “fully autonomous driving,” more substantial computing power is bound to be required to monitor road conditions in the future. Therefore, the demand for advanced manufacturing processes for automotive chips will increase. It will continue to grow at a CAGR of 24%.

However, investors who want to invest in the automotive market still have to pay attention. Although the research firm Gartner agrees that the chip supply situation may not be fully resolved until next year, it also points out that the demand in the automotive industry will fall from a high point in the next few months, echoing the As the Texas Instruments CFO said, corrections affecting other semiconductor markets will eventually affect the automotive sector as well.

Revenue was 3.2-3.4 billion U.S. dollars, lower than the market consensus of 3.43 billion, an annual increase of about 8.6%, falling from the high point of Q3, and the growth momentum has slowed.

The gross profit margin is 57.3% to 58.3%, and the operating profit margin is 35.1% to 36.8%, both of which have fallen from the high point of Q3 but are still at a high level.