Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

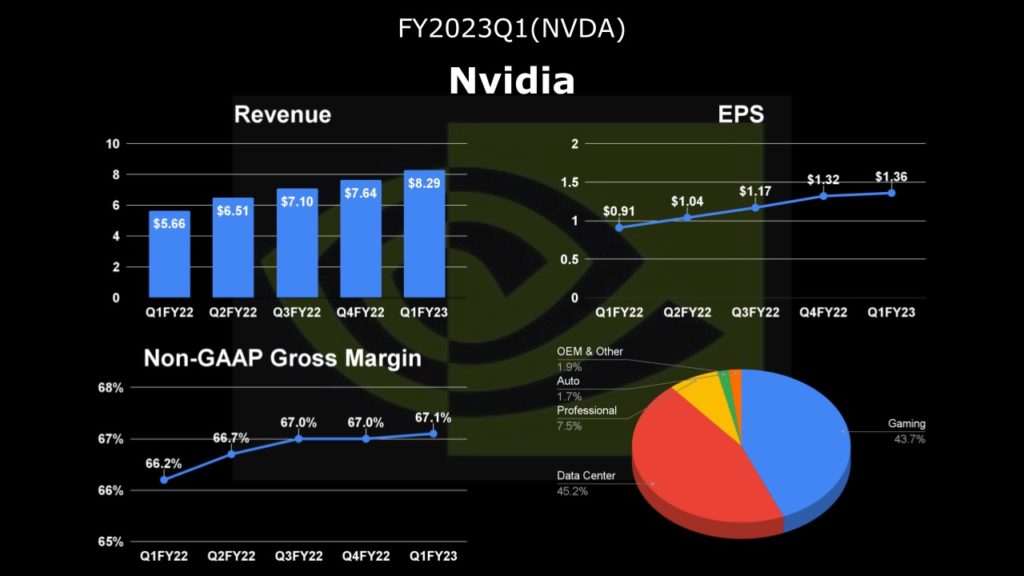

NVIDIA(NVDA) announced its Q1FY23 Financial Results(Earnings Report) on May 25th. Both revenue and profit beat Wall Street expectations. However, the Q2 revenue outlook is relatively conservative, and the market once showed insufficient confidence in NVIDIA’s stock price. In the past two years, NVIDIA’s revenue and profit increased rapidly. Is the future prospect still so good? This article will lead you to look deep into NVIDIA’s operating conditions.

Q1FY23 Financial Results still continue to set records

Revenue sets a record reaching $8.29 billion, the annual growth rate reaches 46.4%. The gross profit margin continued to increase, reaching 65.5%. NVIDIA’s operating income reached $1.87 billion, down 4.5% from last year’s period. The operating margin reaches 22.5% much down than 34.6% in the Q1FY22.

However, what may seem like a bad result at first glance was actually impacted by a loss of $1.35 billion in expenses that recognized the inability to acquire ARM this quarter. If we include this number, NVIDIA’s real operating income this quarter was actually $3.22 billion, a growth rate of 64.7%, and the operating margin rate will remain at a high level of 38.9%.

The Investment loss recognized also affects the Net income. NVIDIA’s Net income was $1.62 billion, down 15.4% from a year ago.

Overall, NVIDIA’s Q1FY23 result was still very strong. Except for the impact of the failure of the ARM merger, both revenue and profit are very good.

The Data Center has set record highs, and the revenue of the Data Center has surpassed the Gaming area.

Data center revenue growth was stronger than expected. First-quarter revenue was $3.75 billion, with an annual growth rate of 83.1%, which has accelerated growth for four consecutive quarters. The main driver, of course, is the demand for artificial intelligence computing continues to grow rapidly.

In Q1FY2023, the Gaming business revenue reached $3.62 billion, up 31% from a year ago. Moreover, it is higher than the 4th quarter of last year which was in the traditional peak season, which shows that the market demand for NVIDIA graphics cards is still very strong.

Professional Visualization business revenue was $622 million in this quarter, up 67.2% from a year ago. NVIDIA continues to invest in hardware for hybrid work environments.

The Automotive and Robotics business revenue reached $138 million, down 10% from a year ago and up 10% from the previous quarter. It was mainly affected by the timing of product cycle updates.

NVIDIA expects revenue to come in at around $8.1 billion. Growth opportunities from the Data Center business are offset by the decline in the Gaming business. It will also be negatively impacted by the Russian-Ukrainian war and China’s lockdown of about $500 million. It is expected to be at the level of 65.1%.

NOTE: This article does not represent investment advice and is solely the author’s opinion on managing the author’s own investment portfolio. Readers are expected to perform their own due diligence before making investment decisions.