Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

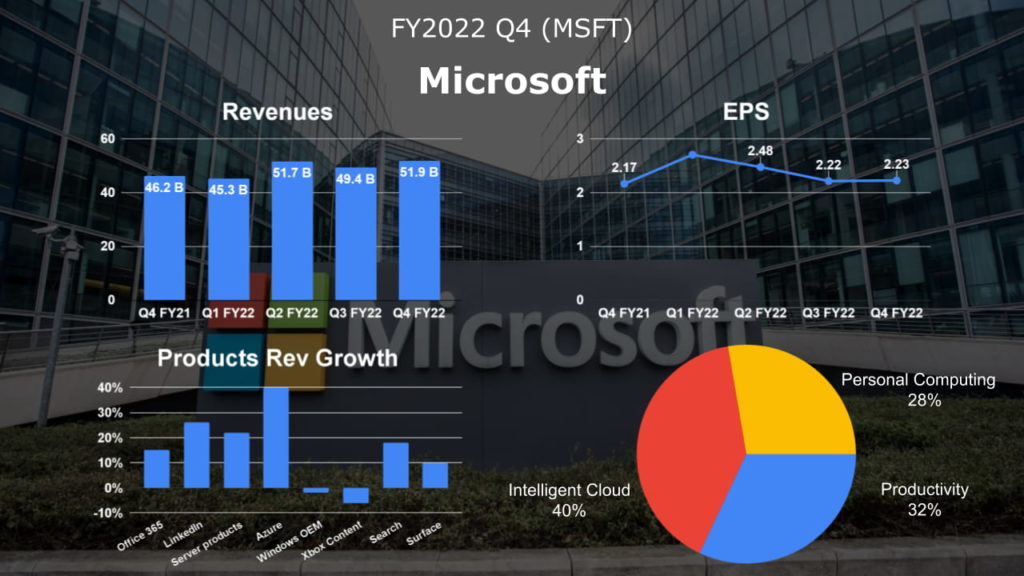

Microsoft, good at Diversification strategy operations, reported an annual increase of 12% in Q2 revenue to 51.9 billion.

Xbox hardware sales -11%, game content -7% and PC sales worsened the most. The main source of Microsoft’s growth and profit is Intelligence Cloud. (including Azure public cloud, SQL Server, Windows Server, etc.) Its revenue increased by 20% to 20.9 billion.

Q1 revenue is expected to reach $49.25 billion to $50.25 billion.

-Estimated annual growth of 10%

-Lower than the analysts’ estimate of 51.4 billion.

Revenue was $51.9 billion and increased 12% (up 16% in constant currency)

Diluted earnings per share was $2.23 and increased 3% (up 8% in constant currency)

Revenue in Intelligent Cloud was $20.9 billion and increased 20% (up 25% in constant currency), with the following business highlights:

· Server products and cloud services revenue increased 22% (up 26% in constant currency) driven by Azure and other cloud services revenue growth of 40% (up 46% in constant currency)

Overall, although Microsoft’s revenue this quarter still maintained growth and set a record high, it has dropped significantly compared to last year’s growth rate. And Microsoft’s profitability has also declined because the rate of increase in operating costs and expenses is higher than the revenue growth rate.

Microsoft (MSFT) Q4 2022’s overall revenue reached $51.9 billion, setting a record high again, with an annual growth rate of 12%. Compared with the 18% growth rate in the previous quarter, there was an apparent recession.

Microsoft’s gross margin for the quarter was 68%, down from 70% in the same period last year.

Microsoft (MSFT) Q4 2022’s operating income reached US$20.5 billion, an increase of 8% compared to the same period last year. The operating income percentage reached 40%, a record low after the epidemic, obviously affected by the surge in operating expenses.

Microsoft (MSFT) Q4 2022’s net income reached $16.7 billion, and YoY grew 2%. Diluted EPS reached $2.23.

Let’s look into the Microsoft Segment information.

Productivity and Business Processes’ revenue this quarter reached $16.6 billion, with an annual growth rate of 13%. It is a significant decline compared to YoY’s 25% or the previous quarter’s 17%.

Revenues from Office Commercial products rose 9 percent, with Office 365 Commercial growing 15 percent, the fourth consecutive quarter of declines. Revenue from Office Consumer products also rose 9 percent, while subscribers grew 15 percent to 59.7 million.

LinkedIn’s performance continues to be strong.LinkedIn revenue increased 26% (up 29% in constant currency), continuing to hit new all-time highs. Dynamic revenue was up 19%, with Dynamic 365 revenue up 31%.

The Intelligent Cloud segment. Revenue was $20.9 billion, increasing 20% and 25% in constant currency.

Revenue decreased 2% and increased 1% in constant currency.

Server products revenue decreased 2% due to a strong prior year comparable that included benefit from an increase in multi-year agreements that carry higher in-quarter revenue recognition, offset in part by demand for our hybrid solutions and Nuance.

Azure and other cloud services revenue grew 40%, driven by growth in our consumption-based services. Although it is lower than the last quarter, it is the same as last year’s level.

Revenue in More Personal Computing was $14.4 billion and increased 2% (up 5% in constant currency). Considering that the overall PC market is in recession, this performance is not bad.

Windows OEM revenue decreased 2%.

Windows Commercial products and cloud services revenue increased 6% (up 12% in constant currency).

Surface revenue grew 10% and 15% in constant currency driven by commercial sales.

In Gaming, revenue declined 7% and 5% in constant currency, in line with expectations. Whether it is software content revenue or hardware sales, there is a decline. Xbox hardware revenue declined 11% and 8% in constant currency. Xbox content and services revenue declined 6% and 4% in constant currency, driven by lower engagement hours and monetization in third-party and first-party content, partially offset by growth in Xbox Game Pass subscriptions.

Search and news advertising revenue increased 18% and 21% in constant currency, lower than expected driven by the slowdown in advertising spend noted earlier, partially offset by the inclusion of three weeks of results from Xandr. Since advertisers have begun to decrease in the 2nd quarter of this year, this performance is quite impressive, especially Google’s search advertising growth rate of only 13.5%.

Microsoft (MSFT) believes that in the upcoming fiscal year 2023 (2022 Q3 – 2023 Q4), they can achieve double-digit growth in both revenue and Operating Income. Operating expenses will grow significantly (YoY) in the first half of the upcoming fiscal year 2023 but slow down in the second half. In terms of operating profit margin, it is expected to remain at the same level as the previous year.

For FY23 Q1, Microsoft (MSFT) expects revenue from the Productivity and Commerce business group to reach $15.95-$16.25 billion. Revenue from the Intelligent Cloud segment is estimated to be in the range of $20.3-$20.6 billion. In the PC business, revenue is estimated to be in the range of $13-13.4 billion.