Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Delving into the contradictions between Reaganomics and Bidenomics, this article evaluates the potential downfall of policy shifts and their effects on the U.S. economy. While some of Biden’s measures have been beneficial, others have raised concerns regarding their long-term sustainability and their impact on American businesses and consumers.

Over the past year, the Federal Reserve has increased interest rates by 500 basis points. Surprisingly, the U.S. economy has shown robust resilience, outperforming investor recessionary expectations set at the start of the year. Market projections suggest a potential 5% QoQ GDP growth rate for the U.S. in the third quarter.

Labor market indicators are bullish, yet public sentiment diverges from these optimistic figures. Gallup polls have consistently indicated a lukewarm reception towards Biden’s economic policies.

In anticipation of his re-election bid, Biden is working to promote his economic policies widely. Hence, understanding the Bidenomics model’s implications on future capital markets, fiscal expenditures, and potential inflationary trajectories is critical for market analysts and stakeholders. So, what exactly is at the core of Bidenomics?

At its core, Biden’s strategy is discernible leftist leaning, emphasizing government-led interventions to bolster sectors such as manufacturing and services.

Historical data spanning four decades show a precise alignment of leftist and rightist policy trajectories with the Democratic and GOP agendas. The GOP has traditionally championed the Reaganomics of the 1980s, emphasizing tax cuts, deregulation, and free trade. This top-down strategy, often referred to as “Trickle Down Economics,” suggests that benefits will flow down to the middle class as a result of stimulating corporate investments through tax cuts.”

Bidenomics advocates a middle-out and bottom-up philosophy, contrasting sharply with the top-down focus of Reaganomics. Recent initiatives underscore this shift:

These policies are designed to augment private investment, foster domestic manufacturing expansion, and generate high-wage job opportunities.

Encouraging companies like TSMC and Samsung to open facilities in the U.S. is a key part of the Democrats’ economic strategy. In summation, while the GOP’s philosophy is to eliminate barriers, the Democrats aim to chart a path for economic prosperity meticulously.

To understand the stark contrasts in the economic policy direction between the Republicans and the Democrats, one needs to delve deep into the origins and progression of economic theories.

Keynesian economics, emerging in the 1930s, significantly influenced the field of economics. The Great Depression of 1929 caused a pervasive slump in consumption. Keynes, a governmental figure, posited that since GDP consists of consumption, investment, government expenditure, and the net of exports and imports, and recognizing that government expenditure could stimulate GDP growth, governments should proactively spend. It gave rise to the metaphorical “digging and filling ditches” theory.

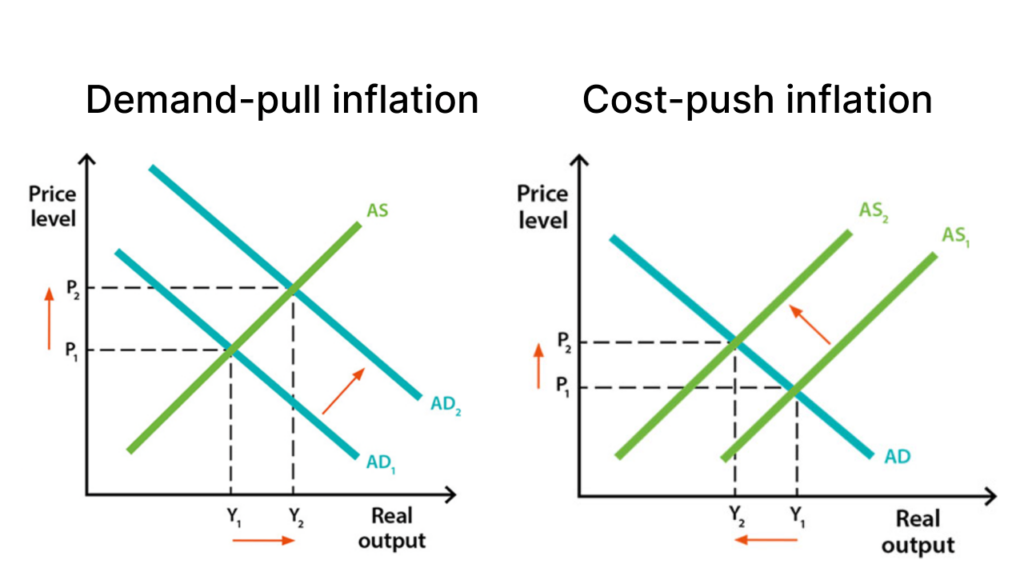

The emphasis was placed on policies benefiting citizens and the crucial role of government-led spending. Infrastructure projects like highways, railways, and public facilities proliferated. The essence was to create a demand-pull inflationary environment.

Basic economic theory presents the price level on the vertical axis and quantity on the horizontal. According to the demand curve, as prices rise, demand shrinks and vice-versa. It gives the demand curve its negative slope. The supply curve, conversely, increases with the price. The equilibrium point is where these curves intersect. The 1930s Keynesian approach shifted the demand curve outwards, spurring both output and price levels. Prices might have risen, but at least active consumption was rejuvenated.

During the 1930s, the Keynesian approach successfully pushed the entire demand curve outward, stimulating both output and price levels. Although prices may have increased, it revitalized active consumption.

The 1950s presented several challenges:

By the 1970s, Keynesianism seemingly faltered, particularly during stagflation. Increased fiscal expenditure only ushers in inflation. A representative depiction of this period would show the supply curve almost vertical, indicating that regardless of demand increases, output remained limited, causing prices to skyrocket. The root cause was the 1970s stagflation coinciding with oil supply shocks from two Middle Eastern wars. No matter the monetary injection, oil remained scarce, driving prices up.

Reaganomics departed from the Democratic approach of relentless monetary easing and fiscal expenditure. The focus shifted to strategic spending on pivotal areas like defense and the ‘Star Wars’ program. Furthermore, tax cuts were championed to let citizens and the capital market function freely. Observably, the right-wing policy pivoted towards laissez-faire economics, asserting faith in the free market’s efficiency.

With the gradual alleviation of supply chain issues, the robust market performance under Reagan secured his position as one of the most admired U.S. presidents.

Bidenomics strategy underscores the belief that confronting an economy like China, with its notable and aggressive technological advancements, cannot solely be managed through the free market mechanisms. State intervention becomes essential.

Three core pillars underpin Bidenomics approach:

However, this approach has contradictions:

Could Bidenomics unintentionally exacerbate particular economic challenges? The current inflation rates, the highest in 40 years, suggest this might be the case.

When supply-induced inflation encounters a left-leaning administration, the result can be even more pronounced inflation, driven by a belief that liberal fiscal spending is the panacea for most economic woes.

While Bidenomics may strengthen U.S. national and semiconductor security, it also risks reigniting inflation. In the long run, such an approach may be detrimental to the sustained economic progression of the U.S.

Addressing supply chain challenges effectively and promoting a genuinely open and free capital market remains pivotal for continued economic momentum.