Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

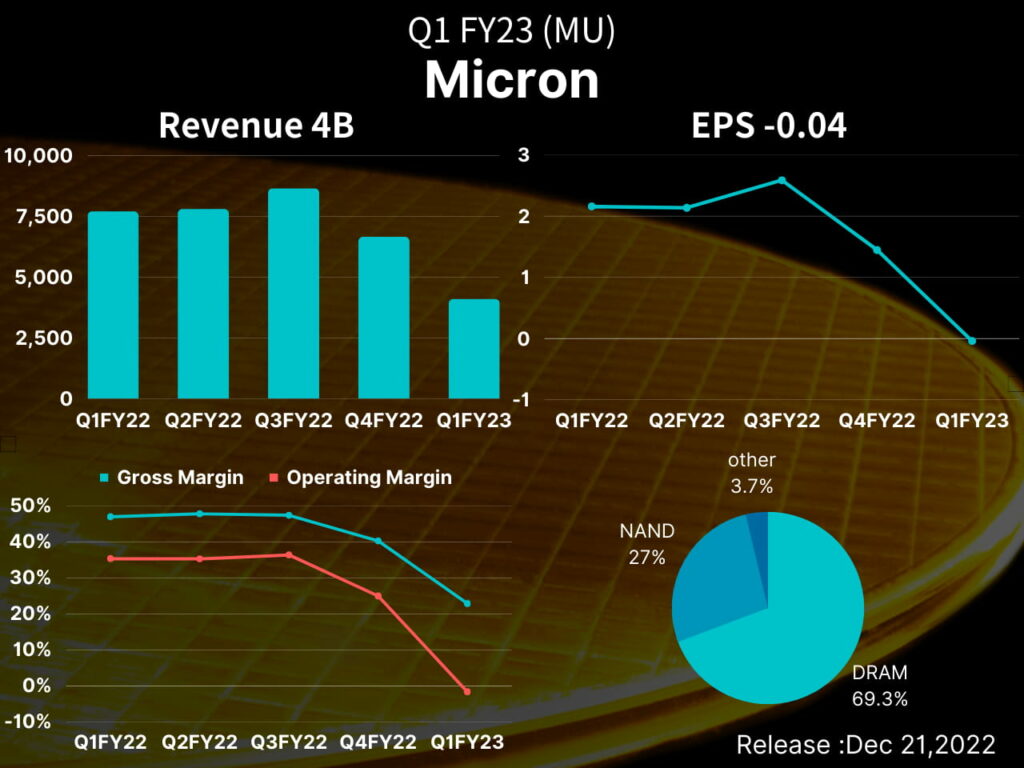

Memory giant Micron (NASDAQ: MU) released its FY2023 Q1 quarterly report, with revenue of $4.085 billion (down 47% year-on-year, lower than the expected $4.15 billion), EPS loss of -$0.04 (lower than expected -$0.02), and gross margin of 22.9% (lower than the expected 26%).

Due to the sharp decline in demand, the company lost pricing power due to too much inventory and then decisively cut spending and production. Micron said it will cut 10% of its workforce (about 5,000 employees) in 2023, suspend share buybacks and bonus payments, and cut capital expenditures for the new fiscal year to 7-7.5 billion (50% less than the previous year). Inventories will return to growth after improving in the second half of next year.

Declining demand coupled with falling prices, Micron’s four significant divisions experienced year-on-year revenue declines, and EPS fell short of expectations for the first time in nearly three years.

Micron revealed that the collapse in shipments has led to a more considerable build-up of inventory than expected, with $8.4 billion in stock on the books this quarter and 214 days in inventory (DIO). With decisive measures, inventory will peak next quarter, and customers’ inventory levels will return to healthy levels in FY2023Q4.

With capital expenditures of approximately $2.5 billion and free cash flow turning negative (-$1.53 billion) for the quarter, capital expenditures will gradually decline, with the CFO downgrading its full-year CapEx forecast and further disclosing the negative impact of production cuts on future results.

The CEO said DRAM and NAND demand would grow to low-to-mid-single-digit in 2022. It is likely to expect 10% and 20% growth in 2023. With slowing terminal demand and piling up customer inventories, demand growth in both years has been below the historical average.

As for the supply side, the CEO pointed out that considering the sluggish market conditions, significant manufacturers will continue to reduce production capacity. The overall market shipment growth rate in 2023 will be lower than the long-term average, of which DRAM will decline from this year, and NAND will be the same as this year. However, the overall market supply and demand still need to be balanced, and the profitability of the memory industry will still face significant challenges in 2023.

DRAM and NAND revenue accounted for 69% (49% year-on-year, 15% quarterly) and 27% (41% year-on-year, 25% quarterly), respectively, and the average selling price (ASP) decreased by about 20% quarterly.

All businesses YoY had negative growth, with Mobile (MBU), which focused on mobile phones, the worst performer (-66%); The Embedded Business (EBU), which covers the automotive and industrial sectors, experienced the smallest decline (-18%), driven by strong growth in automotive applications.

The decline in selling prices led to a significant reduction in revenue. The removal of costs and expenses could not keep up with the shrinkage of income, with R&D expenses rising by 18%, resulting in a gross margin of only 23% (a year-on-year decrease of 24%), and operating profit margin and net profit margin were both turned from profit to loss, reporting -2% and -1% respectively.

Compute, and Networking Business Unit revenue was $1.7 billion with weakness across client, data center, graphics, and networking.

Embedded Business Unit revenue was $1.0 billion, with automotive staying stronger than consumer and industrial markets.

Storage Business Unit revenue was $680 million, while the QLC mix increased to a new high.

Mobile Business Unit revenue was $655 million, a low level partly due to the timing of shipments between fiscal Q1 and fiscal Q2.

“Data Center” players are also not immune to total economic headwinds. The demand for memory in cloud computing will grow at a lower rate than the historical average in 2023, but the long-term trend will remain strong. Data Center operators are adopting the new technology DDR5 from 2023Q1, and related revenue will likely increase in the second half of 2023.

“PC” full-year shipments in 2022 may decline to “high-teens,” and freight in 2023 will further reduce to “low to mid-single-digits” until they are close to the level of 2019.

“Mobile” shipments will decline by 10% in 2022, but thanks to improved demand in China, shipments in 2023 may be the same as this year or even slightly increased.

On the demand side, since mid-October, major DRAM operators have successively negotiated contracts with data center operators such as Amazon (AMZN), Microsoft (MSFT), Google (GOOGL), and other data center operators for 2023.

Considering that manufacturers of PCs, mobile phones, and other applications may refer to the contract results of data center companies, the price decline may spread to more technical fields and add challenges to destocking. Research institutions generally mention that the downstream industry may replenish inventory in the second half of 2023.

To adjust the supply of DRAM, Samsung Electronics plans to adopt a “natural reduction” model of converting memory production lines to foundry production lines. In addition, major DRAM companies such as SK Hynix and Micron will also adjust their investment in equipment to reduce production.

In its last quarterly earnings report, Micron also said that it expects FY to reduce capital expenditure by more than 30% annually in 2023 and announced a 20% reduction in the entire production line in mid-November.

Overall, even if DRAM suppliers are trying to reduce production, the DRAM market will continue the oversupply trend and lead to the continued price decline. It may be in the second half of 2023 to have a chance to ease, and the speed of China’s unblocking and the epidemic situation will be essential.

The outlook for the next quarter, revenue of 36~4 billion US dollars, EPS between -0.72~-0.52 US dollars, gross margin of 6%~11%,

Micron’s Q2 earnings were disappointing, with revenue of $3.8 billion and EPS loss of -$0.62, both of which fell short of analyst expectations ($3.84 billion & -$0.32). CFO pointed out that Q2’s DRAM and NAND shipments will increase, but revenue will continue to decline. In line with the above “price reduction” bargaining method, revenue and free cash flow may not recover until the second half of FY2023 as demand warms up.

The production cuts, which will have a full-year impact of approximately $460 million, are expected to have an effect from the second half of FY2023 and continue into FY2024, with overall FY2024 production being smaller than originally planned.

FY2023 reduction of capital expenditure to 70~7.5 billion US dollars (40% annual reduction), mainly due to the decrease of plant equipment (40% annual reduction). The company’s capital expenditure was primarily in the first half of the year, and in addition to the simultaneous decrease in capital expenditure in FY2024, plant equipment expenditure may further decline.