Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

At WWDC 2024, Apple finally unveiled its AI strategy, easing concerns about falling behind in the AI era – problems that weren’t unfounded.

Over the past two years, Apple was widely considered the least invested in AI among the Big Tech giants, especially in large language model (LLM) development, lagging far behind Google, Microsoft, and Meta. However, at this developer conference, Apple showcased its true strength – a global user base of over a billion iPhone users, Apple’s most powerful asset in the AI era.

Apple’s strategy is based on a simple yet powerful assumption: if smartphones become the primary means for consumers to interact with AI (a likely scenario), then as the dominant player in the smartphone market, Apple has the power to become the gatekeeper of AI applications, deciding which AI services can reach consumers.

In essence, Apple is offering its base of over a billion users in exchange for OpenAI’s services while retaining the possibility of future revenue sharing. This approach has sparked a new perspective: Apple can leverage (or exploit) the efforts of other companies that have heavily invested in LLM and generative AI R&D without having to invest heavily in AI R&D itself, yet still capture a slice of the AI value creation pie.

OpenAI – viewed as the most advanced company in generative AI technology, is precisely the partner Apple announced at WWDC.

The two companies announced a collaboration on the Siri voice assistant. When Apple’s local small and cloud models can’t meet user needs, Apple will leverage OpenAI’s GPT-4o model to provide higher-quality services.

We’re excited to partner with Apple to bring ChatGPT to their users in a new way. Apple shares our commitment to safety and innovation, and this partnership aligns with OpenAI’s mission to make advanced AI accessible to everyone. Together with Apple, we’re making it easier for people to benefit from what AI can offer.

Sam Altman, CEO of OpenAI

According to Bloomberg, Apple won’t have to pay OpenAI for this collaboration. This means OpenAI itself will bear the computing costs required to answer questions. Moreover, if OpenAI can find a business model and profit from Siri’s usage volume, it must share part of the revenue with Apple. On the surface, Apple has all the advantages, so why would OpenAI accept such terms?

The view is that OpenAI aims to establish more robust hedging chips for future games by expanding ChatGPT’s user base through integration with Siri. In fact, among all non-Big Tech AI companies, OpenAI is almost the only one capable of building a massive user base. The so-called AI user touchpoints don’t necessarily have to be hardware providers like Apple; they can also be application software providers like Meta’s social networks. The ChatGPT chatbot is one of the most successful AI user touchpoints in recent years, boasting 180 million monthly active users.

This collaboration between OpenAI and Apple is executing their backup strategy – the primary goal is, of course, to create AI far superior to competitors, but if AI truly evolves into a commodity and distribution breadth replaces technological leadership as the key to success, OpenAI at least wants to control a massive user touchpoint to avoid the awkward position of being just one of many AI model suppliers.

It’s worth noting that OpenAI is not an exclusive partner in this collaboration. Apple will likely partner with local LLM providers, such as Baidu’s Ernie Bot, in the Chinese market. Even in the European and American markets, if Google accepts the same no-fee and revenue-sharing conditions, Apple might also integrate Google’s Gemini into Siri.

For Apple, letting multiple leading LLM providers compete for the default AI application choice on its smart devices can create the most favorable competitive environment.

On the surface, Apple seems to have the upper hand in this business game, leveraging its strong smartphone market position to disadvantage AI R&D companies like OpenAI. However, the reality isn’t so simple – what determines this issue hinges on a crucial premise: how big will the gap be between the technology leaders and followers in generative AI model development?

Regardless of how it’s phrased, the essence of this question remains the same: will the capabilities of large language models become a commodity with little value differentiation?

If the gap between AI model technology leaders and followers is enormous, technology leaders typically enjoy more bargaining power in the market. For instance, when Google developed Go AI, the latest version of AlphaZero completely dominated earlier versions of AlphaGo. With such a vast gap, technologically lagging players have almost no commercial competitiveness, giving technology leaders extreme bargaining power in the market.

If the technological gap between leaders and followers is small, companies like Apple that control the usage platform will have an advantage in the competition.

Take translation AI as an example. Suppose the technology leader has a translation accuracy of 90% while the follower achieves 85%. Although there’s still a technical gap in practical business applications, this difference might be barely noticeable. Whether it’s 90% or 85% accuracy, businesses may still need to arrange additional workforce for corrections and proofreading, and there’s no absolute 0 or 1 difference.

In this scenario, channel operators controlling the usage platform can choose from multiple technology suppliers, thus gaining an advantage in negotiations.

This is the central assumption behind why some analysts are bullish on Apple potentially becoming a big winner in the AI era. If multiple models can achieve similar levels in a specific function, Apple can freely choose partners because consumers won’t feel the difference in product functionality. This gives Apple enormous bargaining power in cooperation negotiations, and these model providers may have to compete by lowering prices or making more concessions to win Apple’s favor.

So, will technological leadership or platform control dominate in the AI era? There’s no definitive conclusion yet.

This has been a hot topic in the AI industry over the past two bullish years of AI development, expressed differently, such as “Will the distance between proprietary closed-source models and open-source models grow larger or smaller?”

There are two main arguments supporting the view that proprietary closed-source models will widen their lead:

The view supporting open-source models catching up mainly believes that leaders will hit a challenging bottleneck period to break through at some stage. This is a common phenomenon in the history of technological development, and it wouldn’t be surprising if it occurs again in the development of large language models.

Interestingly, the open-source camp has two powerful allies in this battle between proprietary, closed-source, and open-source models. First is the Llama series, currently representing open-source large language models. Meta can compete with closed-source proprietary models regarding computing power, funding, and data. Meta is not only one of the most profitable companies among tech giants, able to invest heavily in purchasing NVIDIA GPUs for training, but in terms of data, Meta owns the world’s most potent content network, including text, images, and videos, providing Meta with a robust exclusive dataset for model training.

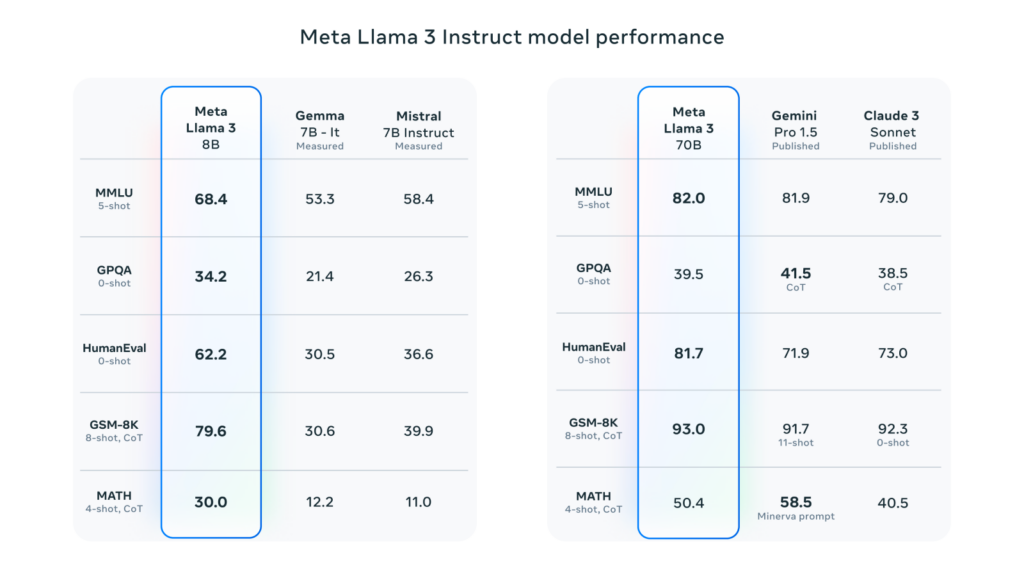

In the recently released Llama 3 model, the 70 billion parameter version scored higher than Google’s Gemini Pro 1.5 and Anthropic’s Claude 3 Sonnet (corresponding versions) in the MMLU test of college-level knowledge, proving that open-source models indeed can catch up with proprietary models. Although the Llama series models are only open-source to a limited degree, in the competitive AI model market, Llama represents a benchmark choice available to everyone without exceptional negotiation.

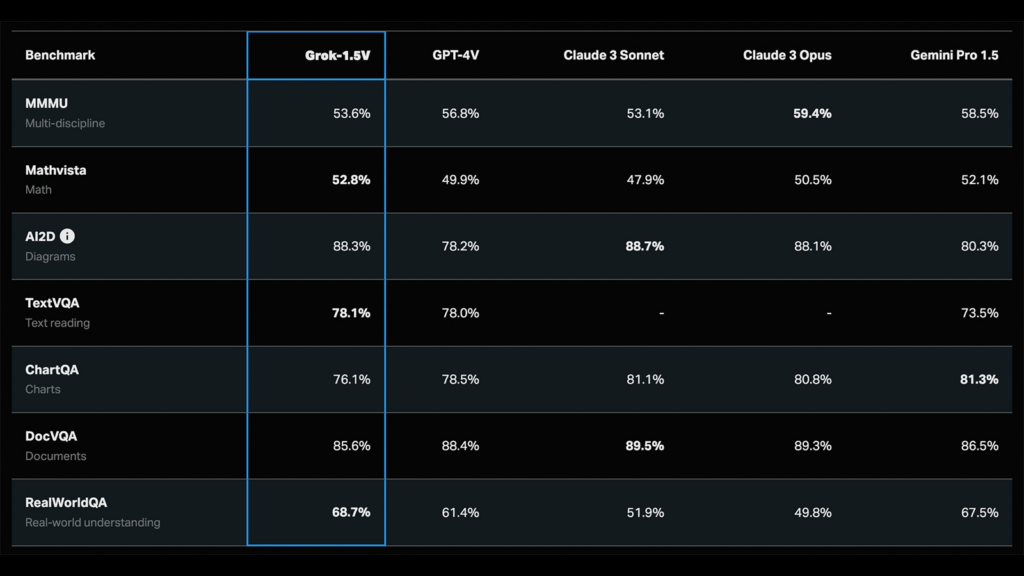

Another strong support for the open-source camp is Elon Musk’s xAI. xAI’s recently launched Grok 1.5V multimodal model has scored close to GPT-4V in multiple tests. xAI shares similar advantages with Meta – whether in terms of computing power, funding, or exclusive datasets (Twitter), xAI’s competitiveness in the large language model field is no less than that of tech giants. Although it started later, the possibility of catching up to close to the current leading proprietary closed-source models in the future is quite likely.

Although experts have yet to reach a consensus on this issue, if a bold prediction were to be made, it’s likely that in a few application areas (such as the military), the gap between leading technology models and followers may be difficult to bridge. However, in most consumer application areas, the gap between technology leaders and followers will likely narrow to a point where consumers can hardly perceive a significant difference.

In other words, technology leaders may have an advantage in winner-takes-all markets. In non-winner-takes-all markets, players controlling touchpoints and channels may have more advantages.

The topic of whether technology leaders (like OpenAI) or touchpoint/channel controllers (like Apple) will prevail in the AI landscape is essentially consistent with a long-standing core game in the business world – the battle between commodities and channels. In traditional business games, commodities try to transcend the limitations of channels. In contrast, channels strive to weaken the influence of commodities and even attempt to launch their own branded products as replacements.

There are no absolute winners in this war. In some cases, certain commodities are so powerful they’re irreplaceable, forcing channels to sell them, like Coca-Cola. In other cases, powerful channels force those more easily replaceable commodities, like a lesser-known sugar-free green tea drink, to accept extremely unfavorable shelf conditions just to be sold in significant channels. The key distinction lies in whether your product is irreplaceable or a replaceable commodity.

This collaboration between Apple and OpenAI is mutually beneficial – Apple sheds its image of lagging in the AI era and leverages its channel advantages to occupy a key position in the rising AI economy. OpenAI gains a massive opportunity to acquire new users, establishing an essential backup for long-term survival.

As for which camp – the channel represented by Apple or the technology described by OpenAI – will prevail in this game, only time will tell.