Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

A profound understanding of the importance of long-term investment and stable returns is acquired in mastering financial knowledge. Moving to the practical aspect, the core of an investment strategy decision-making process can be subdivided into three critical questions: “What to buy,” “How much to buy,” and “When to buy.”

The first element to explore is “What to buy,” which involves the choice of various investment instruments. This choice is not only based on understanding different asset classes, such as stocks, bonds, real estate, and commodities but also needs to consider how these assets align with an investor’s risk tolerance and long-term investment objectives.

The next element is “How much to buy,” concerning the investment portfolio allocation. This is more than a question of quantity; it is about the strategy of allocating funds among different assets. This requires rational asset allocation based on an investor’s risk preference and financial goals, ensuring the diversification and balance of the portfolio.

The final element, “When to buy,” pertains to the judgment of the timing of investment. This involves analyzing market trends and customizing strategies based on individual investment attributes. Whether aiming for profit from price differences or long-term holdings for dividend income, the timing of investment is crucial for achieving investment goals. For instance, poor timing can lead to losses even when choosing quality stocks like Microsoft Corporation (MSFT).

The questions of “What to buy,” “How much to buy,” and “When to buy” are not only applicable to investment but also to everyday consumption decisions.

When faced with the consumption needs of a spouse or children, like the desire to purchase luxury goods, these three questions can be employed for rational decision-making: “What to buy,” “How much to buy,” and “When to buy.”

Let’s explore these three key investment decision elements in detail.

In exploring the “What to buy,” understanding the types of mainstream assets available in the market is crucial. Currently, the assets available to investors can be broadly categorized into four types:

Each of these asset types has its unique characteristics and advantages. Among them, the stock market often occupies a more significant proportion.

Investing in stocks is often considered a key component when discussing asset allocation strategies. Investing in the stock market means owning companies to some extent, a point emphasized by the renowned investor Warren Buffett. Buffett’s investment philosophy emphasizes long-term value investing, which means selecting and holding stocks of companies with good management, stable profitability, and strong market positions.

Stocks are also considered the best hedge against inflation. This is because stocks represent partial ownership in a company. As the economy grows, companies expand and create wealth that often exceeds the rate of price increases. Therefore, when the economy experiences inflation, the stock market tends to maintain its value, explaining why investing in stocks is a wise choice in an inflationary environment.

The concept of Bonds is relatively straightforward: they represent loans to others. When investors purchase bonds, they buy and sell credit in the financial markets. In asset allocation strategies, it is often recommended to focus on U.S. Treasury Bonds, a type of risk-free bond, as opposed to Emerging Market Bonds or Corporate Bonds, which carry higher risks.

U.S. Treasury Bonds are favored because the U.S. government is viewed as the most creditworthy in the world. In times of market panic, investors often withdraw funds from the stock market and turn to U.S. Treasury Bonds. This risk-averse behavior makes U.S. Treasury Bonds a haven during market uncertainties.

Stocks and bonds complement each other in times of market volatility. Bond prices are usually lower when the stock market is overvalued, and vice versa. This inverse relationship means that when the stock market falls, the bond market may provide a cushion, helping investors offset some of the losses in the stock market.

Therefore, stocks and bonds are two essential assets for long-term investors. This dual-track strategy offers potential return opportunities and provides protection during market fluctuations, effectively managing investment risks while achieving financial goals.

Beyond the stock and bond markets, other asset categories like commodities and real estate also play a significant role in asset allocation.

When the stock market is overvalued, meaning stock prices are relatively high, redirecting excess funds to increase commodity allocation can be a wise strategy. This is because commodity assets, such as gold, often exhibit different cyclical and risk characteristics from the stock market.

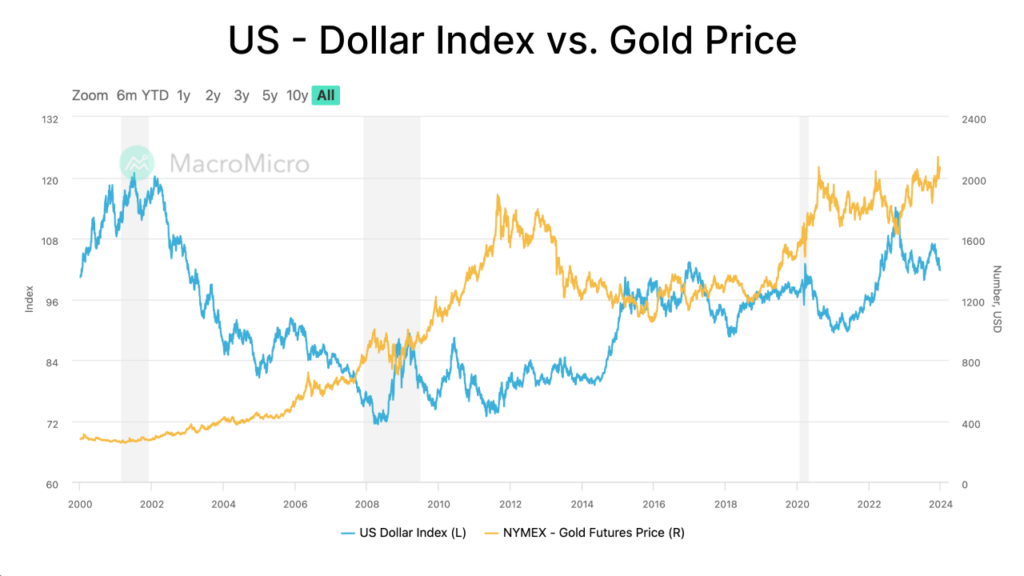

Gold typically shows a high negative correlation with the U.S. dollar. When the dollar weakens, the price of gold usually rises. This is because a devalued dollar means more dollars are needed to purchase the same weight of gold, thereby driving up gold prices. Conversely, when the dollar strengthens, the price of gold usually falls.

This phenomenon occurs because, in global markets, gold is viewed as a store of value, especially during periods of economic uncertainty or currency devaluation. Therefore, investors might seek gold as a hedge when the dollar weakens, pushing its price. On the other hand, when the dollar is strong, gold’s appeal may decrease.

In practice, while stocks and bonds should be the main focus of analysis, the importance of commodities and real estate assets should not be overlooked to achieve a diversified and balanced asset allocation.

“How much to buy” is another core aspect of investment strategy. This question is actually about the proportion of investment in a portfolio.

The allocation percentage in a portfolio is crucial for risk management. For instance, consider two investors, one with a total investment of $20,000 and another with $100,000. If they each invest $10,000 in the same company, the impact of this transaction on their portfolios is markedly different.

For the investor with the lower total investment, investing $10,000 represents 50% of their portfolio, meaning that this stock has a larger influence on their investment mix and exposes them to higher risk, thereby impacting their overall investment outcome.

Conversely, for the investor with a higher total investment, the same amount represents a smaller proportion of their portfolio, with a correspondingly smaller impact on their overall investment result. If other asset classes perform well, they may easily offset any adverse impact of a single asset.

Therefore, “How much to buy” is not just about the amount of money invested in a particular stock or asset but, more importantly, the proportion of these investments in the entire portfolio. Effectively controlling the percentage of asset allocation can minimize losses when mistakes occur and enhance the stability and potential returns of the overall portfolio.

“When to buy” is another key question related to each investor’s investment attributes and strategies.

Different investment targets call for different buying and selling strategies. Some investors focus on a buy-low, sell-high approach; on the other hand, some investors prefer long-term holding, buying at lower stock prices without the urgency to sell at higher prices.

This variation exists because returns from stock investments are not only from price differences but also include dividends and the investor’s cash flow. Long-term investors focus more on the consistent income from stocks rather than just the rise and fall of asset values.

“When to buy” depends on personal investment style and market observation. Understanding one’s investment goals and risk tolerance is key to formulating an effective investment strategy. Investing is not just about predicting the market but also about a deep understanding of personal financial goals and risk capacity.

The three questions of “What to buy,” “How much to buy,” and “When to buy” form the core of an investment strategy, assisting investors in making informed choices in the complex and variable market, thereby achieving their financial goals.