Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

When discussing formulating a personal financial freedom plan, it’s imperative to comprehend a key concept: investment is not the first step in financial management but a strategy built upon a solid financial foundation.

A healthy financial state is the cornerstone of investing. Any amount of capital invested in the stock market or other domains is at risk if your financial situation is unstable. In an emergency, these funds might have to be withdrawn.

Here, we need to redefine the concept of “financial health.” It’s not just about how much capital you possess, but more crucially, your “resilience” — the ability to survive during economically challenging times. This is where the issue of “fragility” comes into play.

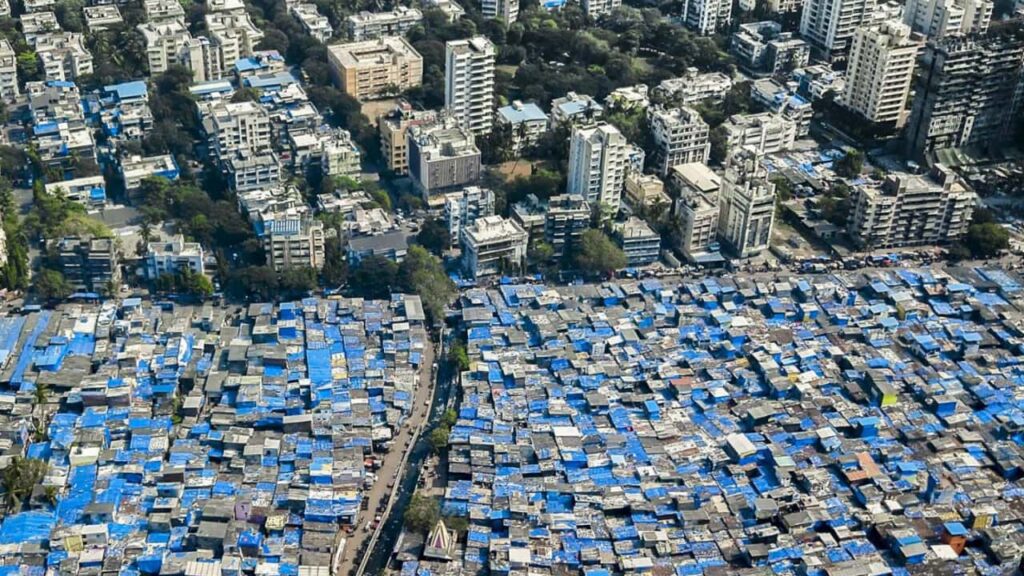

Furthermore, the primary difference between the middle class and the wealthy class is not just reflected in consumption levels or life quality but, more profoundly, in the resilience to financial situations. For example, the transition from the working class to the middle class often significantly improves life quality — acquiring the first car, the first house. However, the transition from the middle class to the wealthy class does not offer a similarly marked improvement in life quality.

The fundamental distinction between the middle and wealthy classes lies in their resilience. The middle class often appears fragile when faced with unemployment, family illnesses, or economic crises. In contrast, the wealthy class possesses a stronger financial safety net, enabling them to withstand these challenges better.

Thus, in formulating a personal financial freedom plan, the focus should be building and enhancing one’s resilience. This means accumulating wealth and, more importantly, creating a financial structure capable of maintaining stability in economic hardships.

In the discourse of financial freedom planning, it is critical to emphasize a core concept: long-term financial stability holds greater importance than short-term wealth accumulation. In life, ongoing survival equates to continual opportunities. Hence, having a clear financial plan to ensure stability in the face of various challenges, such as unemployment, is paramount.

Before embarking on investments, there are several key points to consider:

There are also several pivotal steps in devising a financial freedom plan:

Setting specific and realistic financial goals is the first step to ascend into the middle class and ultimately achieve financial freedom. This is more than just a numbers game; it plans a future lifestyle. For instance, define a savings target for the next five years and develop a plan to achieve it, like saving a certain percentage of income monthly.

While seeking returns in the investment market, enhancing the primary source of income is crucial. Increasing income through skill enhancement or seeking better career opportunities can accelerate entry into the middle class. For example, investing in self-education and skill development can lead to higher pay or more favorable job conditions.

Seeking investment methods that outperform the market average while maintaining stability requires skill and market knowledge. This means focusing on the performance of stocks or funds and understanding the companies and market dynamics behind these investments. For instance, choosing stocks of companies with strong competitive advantages in specific industries or investing in well-managed funds with a stable, long-term performance record.

Learning to save effectively and manage expenditures is key. This is not just about cutting costs but a shift in financial management style. For example, setting a budget and sticking to it, avoiding unnecessary spending, can provide more funds for investment and emergency preparedness.

In summary, the essence of a financial freedom plan lies in carefully considering and balancing all life aspects, from daily expenses to long-term investments and from emergency preparedness to income growth. Through such holistic planning, life quality can be enhanced, and formidable resilience can be demonstrated in the face of unforeseen challenges.

In establishing specific investment objectives, it’s crucial to understand the fundamental differences between long-term and short-term investments. However, for this discussion, assuming a Compound Annual Growth Rate (CAGR) of 5% from stocks is reasonable across the economic cycle and sufficient to accumulate a substantial sum.

Under this strategy, the total capital required to achieve the goal is calculated by setting the desired monthly dividend income. Many investors habitually calculate the retirement corpus based on assumed annualized stock returns. However, it is advised that investment should not be about setting a target and then trying to hit it. Otherwise, there might always be dissatisfaction with the investment returns. A common approach is to aim for a 100% income replacement rate as a retirement goal and then estimate the capital needed before retirement based on this.

This approach facilitates a more structured and realistic pathway towards achieving financial objectives, aligning expectations with achievable outcomes, and mitigating the risks of over-ambitious target setting.

The income replacement rate refers to the ratio of monthly cash flow available post-retirement to one’s salary. For instance, if the current salary is $3,000 and the expected monthly retirement income is $1,200, the replacement rate is 40%. The aim is to achieve a 100% replacement rate, ensuring a post-retirement monthly income equivalent to the current $3,000. To bridge the $1,800 monthly gap, an additional $21,600 per year is needed. Based on a 5% dividend yield from stock investments, a minimum of $432,000 in investment assets should be accumulated before retirement.

Therefore, attaining financial freedom and a 100% income replacement rate is not as far-fetched as it might seem. When planning for long-term investments, many dream of luxurious cars and beachfront properties post-retirement, but such aspirations are often unrealistic and difficult to estimate accurately in terms of required funds. Once these financial goals are quantified, it becomes apparent that they are achievable, and it’s advisable to start working toward them as soon as possible.

This approach underscores the importance of realistic goal setting in financial planning, encouraging a more feasible and grounded perspective toward achieving retirement objectives.

Enhancing primary income occupies a pivotal position in the overall investment plan. This reflects a fundamental investment principle: the amount of capital directly impacts the potential for investment returns. A pertinent adage describes this phenomenon: “The richer you are, the easier it is to make money, but the more you yearn to make money in the stock market, the less likely you are to succeed.”

This does not diminish the importance of investment but highlights that investment should be viewed as a method for the steady growth of assets, not a quick route to wealth. Investments can yield stable returns, providing a clear trajectory for wealth growth. However, they alone cannot make one wealthy, as the effect of compound interest is always closely related to primary income and the scale of principal.

Hence, the focus should be on investing substantial efforts into one’s primary profession, seeking opportunities to enhance income. This strengthens economic capability and lays a larger financial foundation for future investment activities. With increased income, more capital can be allocated to investments, leveraging the effect of compound interest for steady wealth growth.

In this process, the role of investment strategy is supplementary. Wise investment concepts and strategies are necessary, but the core focus should be boosting primary income. This enables the effects of compound interest to operate on a larger capital base, facilitating long-term asset appreciation.

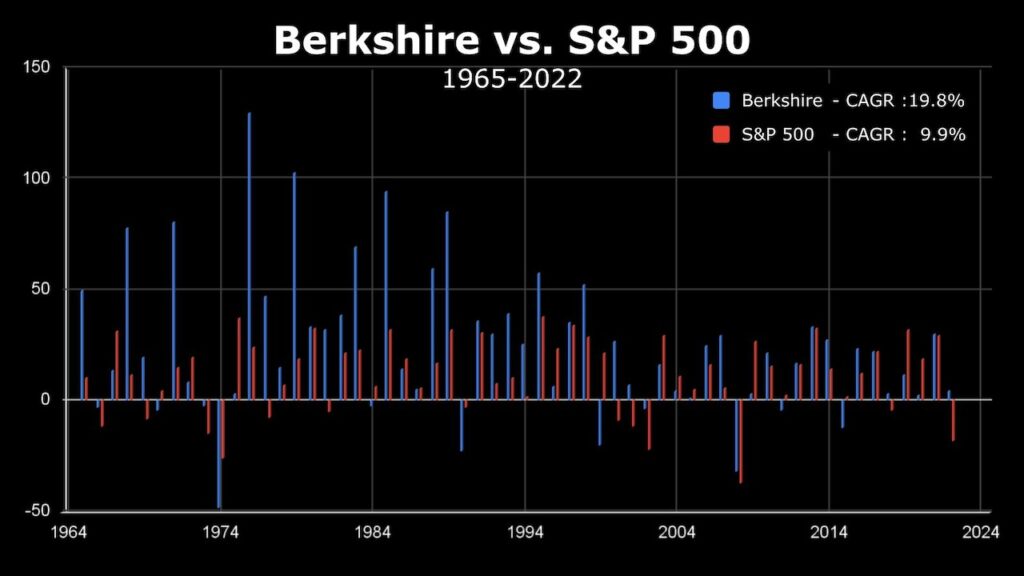

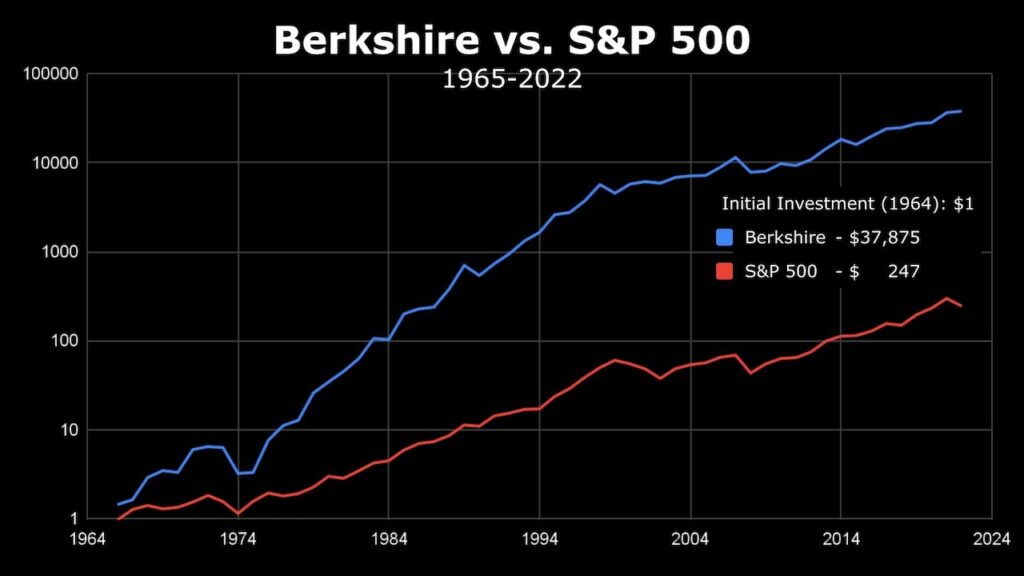

Long-term investors should not expect the high annualized returns of 30% or 50% that are characteristic of short-term investments. Achieving an annual return of over 5% is already a significant accomplishment in long-term investment.

However, Warren Buffett, known as the ‘Oracle of Omaha,’ annually authors a letter to the shareholders of Berkshire Hathaway (Warren Buffett’s Letters to Berkshire Shareholders). At the beginning of these letters, he discloses the annual returns and Compound Annual Growth Rates (CAGR) for investments in Berkshire and the S&P 500. By examining these figures, one can gain insights into the return rates achievable by investing in the top 500 market cap companies in the United States.

Therefore, incorporating these investment or high-dividend ETFs into the asset allocation when planning retirement assets is an ideal choice. They provide a stable cash flow for post-retirement life and aid in achieving long-term wealth accumulation goals. Most importantly, these investments help accumulate sufficient assets before retirement, ensuring quality of life and financial security post-retirement.

When discussing savings, a common misconception is that it necessitates sacrificing quality of life for frugality. However, saving does not necessarily correlate with reduced quality of life or require excessive cost-cutting.

True saving is more about efficiency and smart consumption. It means seeking cost-effective options when purchasing products or services. When greater benefits are obtained with less expenditure, it’s a form of saving. In other words, saving is not merely about putting money aside but making wiser choices in spending.

For instance, they avoid expensive luxury items solely due to their brand and choose durable, practical, and reasonably priced products. This consumption approach satisfies needs without imposing unnecessary financial burdens.

In planning for financial freedom, meticulous calculation and management of primary income, taxes due, and savings amounts are necessary. This entails comprehensive financial planning to ensure a balance among income, expenses, and savings, progressively moving towards the goal of financial independence.

In summary, saving is a process that requires careful planning and smart choices. By enhancing spending efficiency, more wealth can be accumulated, and financial freedom can be gradually achieved without sacrificing quality of life.

Offering a practical and easy-to-follow budgeting method is crucial for those beginning to design a budget. This approach suggests deducting a predetermined saving amount from monthly income and multiplying the remaining amount by 80%, providing the maximum discretionary spending for the month. This method accounts for often-overlooked minor expenses in daily life, such as occasional coffee or snack purchases.

For those who feel they “don’t have enough money to manage finances,” starting with enhanced consumption efficiency while working to build and increase savings is recommended. Even with limited income, through smart spending and effective saving, a foundation for the long-term goal of financial independence can still be established.

For those short on time, choosing a passive investment strategy like systematic investment in funds is a wise option. This method allows automatic deductions from an account for investments, reducing the time and effort needed to manage and track investments while maintaining growth in sync with the market.

In summary, the key to achieving a financial freedom plan lies in comprehensively understanding one’s financial status, devising a reasonable monthly budget, setting quantifiable investment objectives, enhancing primary income, and saving wisely. Even individuals with modest means can progressively move toward financial independence through these steps. This plan is not only applicable to those seeking to improve their financial situation but also to those striving for higher financial goals.

This comprehensive approach integrates various aspects of financial management, making it a viable roadmap for individuals at different stages of their financial journey. The emphasis on practical steps and realistic goal setting makes it a pragmatic guide for achieving financial stability and growth.