Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

During recent events such as the Russia-Ukraine war and the Israeli–Palestinian conflict, global financial markets have been significantly disrupted. This article revisits history to explore the performance of the U.S. stock market during past major wars, revealing the short-term and long-term impacts of war on the stock market.

“Buy when there is blood in the streets.”

Nathan Rothschild

In the investment world, an old Wall Street adage offers profound insight: “Buy when there’s blood in the streets, even if the blood is your own.” This viewpoint can be understood from two perspectives.

The first is through the lens of Cyclical Investing, as echoed by Warren Buffett’s famous saying: “Be fearful when others are greedy, and greedy when others are fearful.” This strategy emphasizes buying in during market panics, seizing opportunities at the bottom of the stock market.

The other perspective reveals a harsh reality: during the outbreak of war, with massive bloodshed and loss of life. Investing in such a backdrop, to some extent, can be seen as war profiteering.

Wars are usually a heavy burden on a nation’s economy, but the U.S. stock market is an exception. Certain industries, like defense and technology, experience significant growth due to wartime demands. Comparing the trends of the U.S. stock market with historical wartime trends reveals a startling consistency.

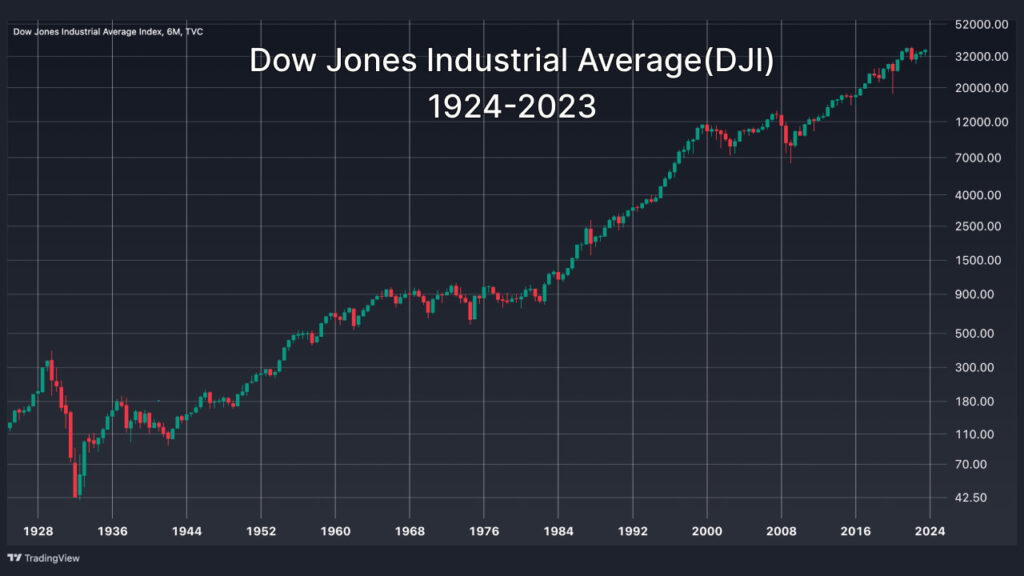

Reflecting on the past century, the United States has experienced numerous wars, yet these conflicts seem not to have hindered the long-term growth of the stock market. On the contrary, each war has seemingly been accompanied by a significant rise in the U.S. stock market. To date, the U.S. stock market has risen by over 1000 times, forming a distinct upward trend line.

1941 was an epoch-making year for the U.S. stock market. That year, Japan’s surprise attack on Pearl Harbor dealt a huge blow to the United States: 20 warships and 300 combat aircraft were lost. This sudden assault shook America and also triggered severe fluctuations in the stock market. In the second half of 1941, the Dow Jones Industrial Average plummeted rapidly, showcasing the immediate impact of war on the economy.

In early 1942, the Japanese forces, sweeping through the Pacific War, successively occupied Singapore and Malaysia, and eventually forced the surrender of nearly 80,000 U.S. troops in the Philippines. This series of military defeats plunged the U.S. stock market into a bear market that lasted nearly a year. Investors were extremely worried about the uncertainty of the war, leading to a slump in the stock market.

However, the Battle of Midway in mid-1942 became a turning point for the U.S. stock market. In this battle, Japan lost four aircraft carriers, a heavy cruiser, and over 300 aircraft, suffering a major blow to its military strength. With this victory, the U.S. military and political prospects began to clear, directly reflecting on the stock market. Following the victory at the Battle of Midway in 1942, the Dow Jones Industrial Average began to rebound, experiencing a significant surge of 114% by the end of World War II in 1945.

One of the pivotal events of the 1950s was the outbreak of the Korean War. This conflict, erupting between South and North Korea, saw both sides capturing each other’s capitals several times. The U.S. forces suffered around 140,000 casualties in this campaign, a significant loss for the United States. In the early stages of the war, many investors were filled with uncertainty about the future of the stock market, impacting its performance to some extent.

Despite the stock market’s performance not being as robust as during World War II, from the outbreak of the Korean War in 1950 to its conclusion, the U.S. stock market still achieved a growth of 33%. This demonstrates that even amid significant casualties during war, the U.S. stock market managed to maintain positive growth. This phenomenon indicates that the stock market does not always react negatively to war news and can sometimes surge contrary to expectations.

During this brief two-year period of conflict, the Dow Jones Industrial Average experienced a significant rise. The index climbed from 160 points at the outbreak of the war to 290 points. This increase reflects investors’ expectations of economic changes and increased government military spending due to the war.

The Vietnam War entered a new phase in 1961 when North Vietnam invaded South Vietnam, prompting U.S. intervention. This intervention triggered a significant and prolonged rise in the U.S. stock market. The market’s response at this time seemed to reflect investors’ expectations of increased government military spending and potential growth in related industries during the war.

However, as the Vietnam War prolonged, the stock market’s optimistic sentiment began to be challenged. By 1974, the U.S. stock market exhibited a marked downward trend, with the Dow Jones Industrial Average plummeting from 1040 points to 500 points. It’s noteworthy that this sharp decline wasn’t directly caused by the Vietnam War, but was influenced by the Oil Crisis, triggered by the Middle East’s issues with Israel at the time. This event highlighted how the stock market is not only affected by domestic events but is also highly sensitive to global political and economic turmoil.

Related Articles:

Exploring the Three Oil Crisis: The History of Energy Crisis and Their Extensive Impact on the Global Economy

In 1990, the Gulf War erupted, with a coalition led by the United States bombing Baghdad. From 1990 to 1993, during the war period, the Dow Jones Industrial Average in the U.S. stock market achieved an approximate 50% increase over these three years. This data demonstrates that during short-term wars or the initial stages of a war, the U.S. stock market often exhibits a significant upward trend.

In 1999, NATO’s bombing of Yugoslavia marked the beginning of the Kosovo War. In this brief 78-day conflict, the Dow Jones Industrial Average achieved an approximate 19% increase in just two months. This scenario once again proves the potential short-term positive impact of the early stages of a war on the stock market.

The Iraq War broke out around 2003. In the six months following the start of the war, the Dow Jones Industrial Average saw a rise of around 32%. Additionally, this period coincided with the end of the dot-com bubble bear market, leading the U.S. stock market into a long-term bull market phase that lasted until the 2008 subprime mortgage crisis. This phase of stock market performance illustrates that war does not always have a long-term or short-term negative impact on the stock market.

Observing the overall performance of the U.S. stock market, it becomes apparent that it is hardly swayed by short-term sentiments or events. Instead, the long-term trajectory of the market more significantly reflects the growth of global economic power. This viewpoint is supported by renowned investor Warren Buffett, who made his first stock investment in the spring of 1942. At that time, despite the media being filled with bad news of war losses, Buffett firmly believed that with the increase in the U.S. military’s production capacity, America would ultimately prevail.

Investing in any country’s stock market is essentially investing in its national destiny, implying that a nation’s military success is interconnected with its economic strength. Under this logic, America’s military victories are not just triumphs on the battlefield but also drivers of economic and wealth growth.

The American economic model relies on three main pillars: Currency, Military, and Technology. These three pillars collectively influence the stability and growth of the U.S. stock market:

When dealing with geopolitical conflicts and other global events, these factors are often seen as potential buying opportunities in the U.S. stock market. These events are generally considered temporary and not significant enough to disrupt the long-term growth trend of the U.S. stock market. Therefore, for visionary investors, these events provide an opportunity to enter the market rather than a reason to retreat.

Historical data suggests that the impact of wars on the U.S. stock market is usually positive or neutral. For instance, major conflicts like World War II, the Korean War, the Vietnam War, the Gulf War, the Kosovo War, and the Iraq War did not cause long-term negative impacts on the stock market. Often, wars spur economic activity and technological innovation, subsequently driving the stock market upward. However, investors should still cautiously approach investments during wartime, analyzing global economic trends and market fluctuations carefully.